Records Retention Policy:

Policy:

The Organization will retain records in an orderly fashion for time periods that comply with legal and government requirements.

Scope:

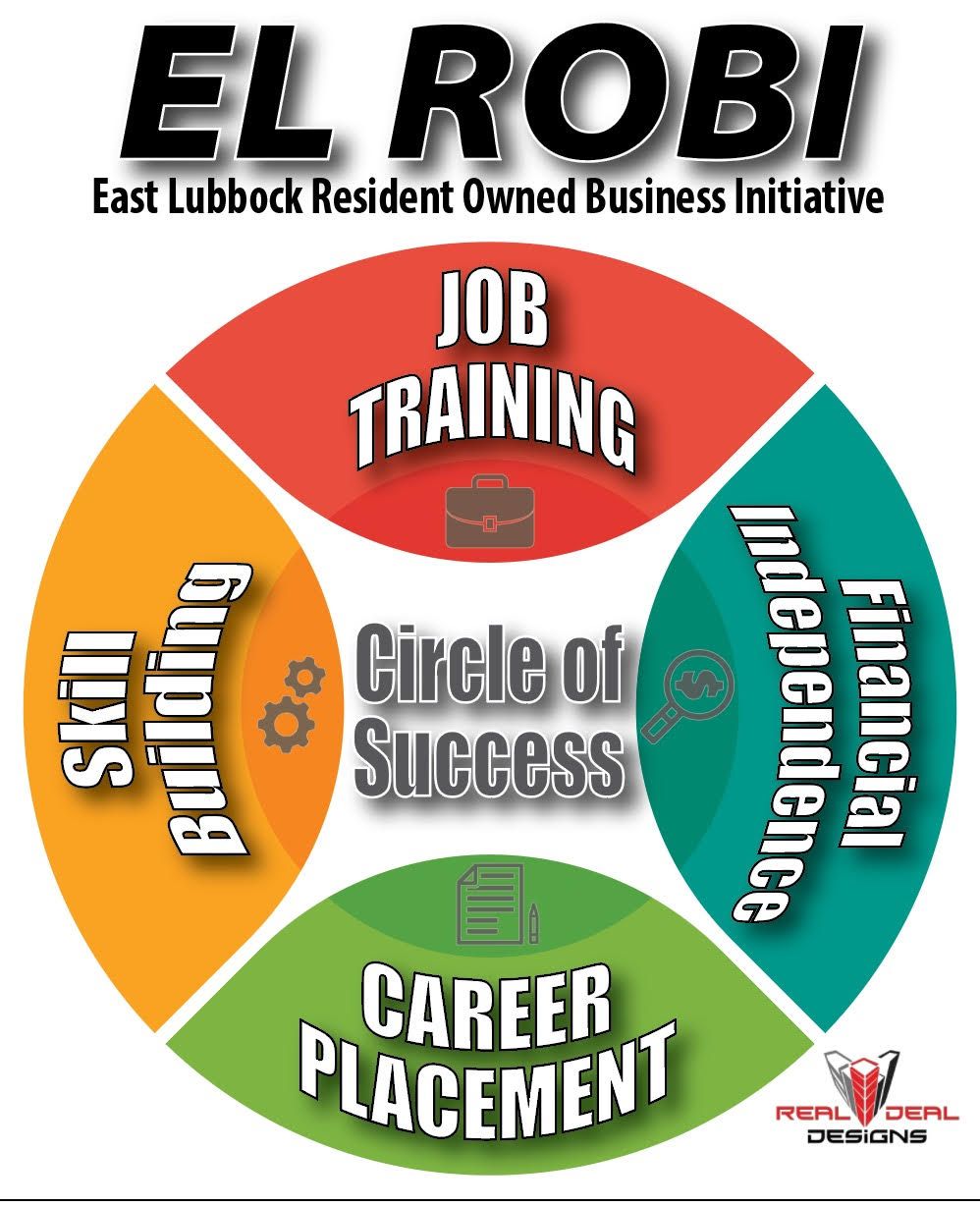

These procedures apply to EL ROBI and its business documentation.

Policy and Procedures:

Storage

- Files currently needed for day today operational activities will be stored in office area. Employees should be sensitive to keep confidential files or materials in locked file drawers or locked offices when the employee is not present. Files that are no longer needed for daily functions should be archived (guidelines follow).

- Storage of archived records falling within the records retention schedule below are maintained in the basement locked storage area of the building.

- Files should be stored in boxes with similar items, dates and retention periods.

- Record Retention Guidelines The following holding periods will be utilized for the maintenance of the documents listed below

- Accounts Records

- Accounts payable/receivable

- 7 years

- Audit reports

- Permanent

- Expense report

- 7 years

- Financial statements (annual)

- Permanent

- Void Checks

- 7 years

- Trial balances (Annual)

- Permanent

- Bank statements/reconciliations

- 7 years

- Client files?

- 4 years